Executive Summary

- Donor-advised funds (DAFs) have emerged as essential vehicles for philanthropy, facilitating nearly $55 billion in grants to charity in 2023 alone. They offer donors flexibility, ease of use, and accessibility, enabling significant positive impacts on communities nationwide.

- Analysis of forty large community foundations and ten of the largest national DAF sponsors (by assets) reveals varied payout rates, with community foundations averaging 17.1 percent and national sponsors averaging 25.4 percent over a three-year period. These rates align closely with voluntary industry benchmarks, demonstrating robust grantmaking.

- The data reveal a majority of foundations had average flow rates between 50 and 109 percent, while one in four had average flow rates between 90 and 109 percent.

- Among large national DAF sponsors, median account balances are relatively small. On average these accounts are typically around $20,000, while the vast majority are smaller than $250,000.

- This analysis covers sponsors holding 89 percent of DAF accounts. Among those, 100 percent enforce stringent and well-defined inactivity policies. Inactivity policies and guidelines ensure responsible fund usage and engagement within the philanthropic ecosystem.

- DAFs are widely accessible, with many community foundations and national sponsors often having no or low minimum contribution requirements.

- As DAFs continue to evolve and grow, understanding current trends and practices is vital for informed discussions about how donors use these vehicles to drive meaningful change in communities around the country.

- Real-life examples showcase the transformative potential of DAFs, from supporting health-related causes to aiding those affected by crises like Hurricane Helene in North Carolina.

Introduction

In the world of philanthropy, donor-advised funds (DAFs) have become a vital charitable giving vehicle. They offer Americans the ability to strategically and thoughtfully support the charities and causes they care about most. Generous donors are increasingly using DAFs as a philanthropic tool to make an enormous positive impact in communities around the country, because they provide donors with flexibility, ease of use, and accessibility in their charitable giving. Donors gave nearly $55 billion in grants to charity from DAFs in 2023 alone, with charitable grants from DAFs nearly doubling over the five-year period 2019–2023.1The 2024 DAF Report. National Philanthropic Trust, November 12, 2024. https://www.nptrust.org/wp-content/uploads/2024/11/2024-DAF-Report-NPT.pdf.

Prior research on DAF trends finds average payout rates around 18 percent to more than 20 percent, depending on the measure of payout rate used.2See page 10 of the Technical Appendices to the 2024 National Study on DAFs: “The National Study on Donor Advised Funds.” DAF Research Collaborative, February 2024. https://johnsoncenter.org/wp-content/uploads/2024/02/DAFRC_TechnicalAppendix.pdf. For example, the National Philanthropic Trust (NPT) methodology finds a payout rate of 23.9 percent for 2023, while the DAF Research Collaborative uses an even more conservative measure and finds a three-year average (2020-22) payout rate of around 18 percent.3“The National Study on Donor Advised Funds.” DAF Research Collaborative, February 2024. https://johnsoncenter.org/wp-content/uploads/2024/02/DAFRC_Executive_Summary_Key_Findings.pdf.

The growing use of DAFs as a giving vehicle has garnered attention, with critics saying DAFs are used to hoard charitable dollars and contribute to purported wealth inequities. However, Philanthropy Roundtable analysis of data from forty of the nation’s largest community foundations and ten of the largest national DAF sponsors sheds new light on the widespread adoption and diverse practices of DAF usage. While our prior analysis provided insights into community foundation use of DAFs in California, this report provides a broader picture of DAF trends, payout rates, account minimums, and inactivity policies.4Salmon, Jack. “Community Foundation Use of DAFs in California: Payouts, Flow Rates, and Inactivity Policies.” Philanthropy Roundtable. November 2, 2023. https://www.philanthropyroundtable.org/resource/community-foundation-use-of-dafs-in-california/.

Payout rates from DAFs have also been the subject of increasing scrutiny, with critics saying rates are too low, potentially delaying funds from reaching charitable causes. This perception reflects a fundamental misunderstanding of the purpose and structure of DAFs. One of the core advantages of DAFs is the flexibility they offer donors. DAFs allow donors to manage their giving based on personal timing and strategy. For instance, donors may choose to make grants immediately after contributing to the fund or take a more deliberate approach, saving for larger, more impactful gifts over time.

Critically, the goal of DAFs is not to achieve a 100% payout rate within a short period. Instead, they are designed to provide donors with the ability to align their giving with both personal timelines and strategic objectives.

Some DAFs are endowed, which adds another layer of consideration. Endowed DAFs often include restrictions on the timing and size of payouts, specifically to ensure the sustainability of long-term charitable efforts. These restrictions are not arbitrary; they are structured to support the donor’s philanthropic mission over many years, preventing premature depletion of the fund and ensuring consistent, ongoing support for the causes they care about.

Using the latest available data (fiscal years 2020, 2021, and 2022) on 990 filings, we examine forty large community foundations and the ten largest national DAF sponsors, which collectively represent 76 percent of all DAF grantmaking and 79 percent of all DAF assets in 2022. These 50 organizations were the largest by asset value among community foundation and national sponsors. Among these DAF sponsors, the number of DAF accounts exceeds 428,000, with $179.1 billion in assets. This substantial figure indicates DAFs have become a popular and significant mechanism for charitable giving among American donors. This research complements existing comprehensive reports such as those of the DAF Research Collaborative or the annual DAF report by NPT by combining different aspects and measures of DAF usage into one report.

Methodology

This analysis is a sponsor level analysis (not an account-level examination) and includes DAF data from Schedule D of Form 990. In total, 200 filings (Form 990) were examined to calculate payout rates and flow rates for DAF sponsor organizations (fifty filings over each of the four years, 2019-2022). The flow rate is the proportion of grants being paid out by DAF accounts compared to the contributions they receive. The payout rate is the percentage of DAF assets granted to charitable causes annually. The payout rate represents the share of total assets within DAFs granted out in a given year.

To measure the payout rate, we utilized the same approach as the National Philanthropic Trust, by calculating the value of DAF grants in the current year as a share of DAF assets at the start of the current year (end of the prior year). The flow rate represents the share of one year’s contributions into a DAF granted out that year. To measure the flow rate, we calculated total grant value as a share of total contribution value, both for the current year. We did this over a three year period, 2022 (using 2022 and 2021 990 filings), 2021 (using 2021 and 2020 990 filings), and 2020 (using 2020 and 2019 990 filings).5This method is only one option for measuring flow rates. It may actually understate the flow slightly if compared to an alternative method that uses current years’ grants as a share of the prior years’ contributions.

To calculate mean payout rates, we added together the payout rate for each respective DAF sponsor, then separately divided the total by the number of sponsors for community foundations and national sponsors. To derive a median payout rate, we arrange the payout rates for each DAF sponsor in numerical order to arrive at a middle figure. The pooled mean payout rate is found by dividing 100 by the total pooled value of DAF sponsor assets (beginning of year) and dividing it by the total pooled value of DAF sponsor grants. When calculating the distribution of payout and flow rates, we use a three year average rate for each of the DAF sponsors by adding the rates for 2020, 2021, and 2022 together and then dividing the total by three. The account minimum opening data was publicly available for the vast majority of DAF sponsors on their websites. For those that didn’t list account minimum requirements, we surveyed the sponsors about their policies on minimum opening requirements. Similarly, inactivity rules are often listed on community foundation and DAF sponsor websites. However, we found that about one in three do not list inactivity rules on their website or in policy and guideline documents. We surveyed sponsors who did not publicly list their inactivity guidelines and followed up after one week for those we did not hear back from. Among those who listed their policies or responded to our requests, 83 percent of community foundation DAF assets are represented in our final analysis and 89 percent of national sponsor DAF assets from our full sample.6The data on minimum opening requirements and inactivity time frames reflects the percentage of DAF accounts that have these specific conditions, not the percentage of sponsors or the total DAF assets.

The Impact of Donor-Advised Funds

The DAF space is full of moving stories about donors who use DAFs to support the causes they care about deeply. For example, Ava Claire DeVine, known for her radiant spirit, tragically passed away at 21 in a car accident.7“Why We Give: The DeVine Family.” FOCUS – Stories That Empower, Inspire and Inform. March 26, 2024. https://philanthropyfocus.org/devine-family/. To honor her memory, her parents established the Ava Claire DeVine Foundation, dedicated to aiding girls and women affected by sex trafficking, a cause close to Ava’s heart following her high school research project on the issue. Through a DAF at Foundation For The Carolinas, her light continues to shine, offering hope to survivors of human trafficking, domestic violence, and sexual exploitation. DAFs are perfect charitable vehicles for more than just memorializing legacies. They also provide ease of use, low administrative burdens, and succession plans for continued family giving. For example, Bill and Sarah Walton (not related to the Walton Family of Walmart) have held a DAF account with DonorsTrust since 2014.8“How the Waltons Bridge Traditional and Policy Charitable Interests.” DonorsTrust. July 9, 2019. https://www.donorstrust.org/waltons-bridge-traditional-policy-charitable-interests/. Both Bill and Sarah are active in a variety of philanthropic pursuits, including giving to arts organizations like the National Gallery of Art, and funding habitat and species preservation. The Waltons emphasize the value of using a DAF as the sponsor helps with the strategy of giving small dollars to a group, like seed venture capital, and then if the recipient does great work, the donor can give larger gifts. Donor intent was another important consideration Bill and Sarah took into account when they chose to open a DAF with DonorsTrust. Bill Walton noted: “Steering it to end up in good hands is very difficult. That is where DonorsTrust can be very helpful.”

DAFs also provide flexibility for donors who wish to plan their giving strategically, which proves especially valuable in times of crises. For example, Greater Cleveland-area philanthropists Ashley and Michael Fisher have long been passionate advocates for health-related causes, particularly since their son was diagnosed with Type 1 diabetes.9“Stories of Giving: Ashley and Michael Fisher.” Cleveland Foundation. October 26, 2022. https://www.clevelandfoundation.org/2022/10/stories-of-giving-ashley-and-michael-fisher/. As they saw the toll the mental health crisis was taking on a health care system already stressed by the physical health emergency of COVID-19, they were inspired to act. The couple donated $2 million from their Cleveland Foundation DAF to UH Rainbow Babies & Children’s Hospital, helping expand the network of mental health services for teens and young adults across the region.

While establishing a DAF account at a community foundation can offer a community-based strategy for advancing a donor’s charitable mission, DAF accounts are also valuable tools for supporting national charities or specific charitable goals. For example, for over a decade, Peter and Kendra Amico of Orlando, Florida, have fostered children. But it was when they welcomed 17-year-old Alyx that they realized the unique challenges faced by teenagers in foster care.10“Homes For Foster Teens.” Fidelity Charitable. September 30, 2021. https://www.fidelitycharitable.org/articles/homes-for-foster-teens.html. Using their Fidelity Charitable DAF, they initiated TeenEmbrace, a program supporting foster families of older kids. With impressive results, including a 94 percent average placement stability rate among 170 participating teens in its first year, TeenEmbrace addresses the critical need for stability and support for older foster youth. With the ability to donate appreciated stock and investment growth in their DAF, the Amicos had an additional $42,000 available to give—funds that almost completely covered the cost to establish the TeenEmbrace pilot and help change the outcome for those 170 children.

In the aftermath of Hurricane Helene, which devastated the southeastern United States and claimed more than 230 lives, charitable organizations provided much-needed relief on the ground. The North Carolina Community Foundation (NCCF) activated its Disaster Relief Fund, supporting recovery efforts for individuals and communities in the areas impacted by disaster. NCCF manages over 360 DAFs, which typically make up about two-thirds of all grants made to individuals and organizations by the community foundation. With over $10 million raised, NCCF will continue awarding grants from the Disaster Relief Fund to eligible organizations in 2025. The generosity and flexibility of these DAF accounts play a pivotal role in rapidly responding to natural disasters and helping ongoing recovery efforts.

Finally, DAFs can be used to support causes that permeate across borders. For example, amid the conflict in Ukraine, over 16 million Ukrainians have sought refuge in neighboring countries, with 88 percent being women and children, many separated from family.11“Ukraine Update: 20+ Charities on the Frontlines.” National Christian Foundation. February 24, 2024. https://www.ncfgiving.com/stories/help-for-ukraine-10-charities-on-the-frontlines/. Charities worldwide have mobilized, providing aid such as rescue missions, food, shelter, transport, medical care, and spiritual support. Thousands of Christian givers have used their DAFs at the National Christian Foundation, which has allocated nearly $75 million in grants in the first two years of conflict. Through their DAFs they strive to ensure no one, especially the most vulnerable, is left behind amid the crisis.

These examples demonstrate the remarkable flexibility and beneficial impact DAFs can have across a wide range of important causes. DAFs empower philanthropically minded individuals to make substantial contributions to the issues and organizations they feel most passionate about, creating an enduring legacy that will ripple through generations.

DAFs offer private foundations a flexible space for experimentation and innovation in grantmaking. Traditional philanthropic strategies may not always address complex and evolving societal issues adequately. DAFs allow foundations to explore novel and unconventional approaches to tackling challenges and achieving their mission.

These real-life stories showcase how DAFs can be leveraged as powerful tools for driving meaningful, positive change within our communities. They serve as motivating illustrations of the transformative potential of DAFs when utilized strategically and with sincere intentions to better our world. Whether supporting medical research, providing educational opportunities, conserving the environment, or any other worthy endeavor, DAFs enable donors to direct their generosity in ways that align with their deepest values. This unique giving vehicle facilitates sustained philanthropy and maximizes the ability of caring citizens to shape a brighter future for all.

A Snapshot of Daf Accounts at National Sponsor Organizations

Many national DAF sponsor organizations publish annual reports which offer valuable insights into data and trends. These reports provide a snapshot of how donors use DAFs at national sponsors. Fidelity Charitable provides data on median DAF account balances, which stood at $21,267 in 2023, with 90 percent of DAF accounts being smaller than $250,000.12“2024 Giving Report.” Fidelity Charitable. https://www.fidelitycharitable.org/content/dam/fc-public/docs/insights/2024-giving-report.pdf. Similarly, Vanguard Charitable says almost half of its DAF accounts have balances below $50,000.13“Why Giving Matters: Donors give more effectively over time with a donor-advised fund.” Vanguard Charitable. https://www.vanguardcharitable.org/why-giving-matters-2023.

When it comes to average grant sizes, Fidelity Charitable finds an average of $4,625 for each grant made in 2023. While providing data on median grant sizes, Morgan Stanley Global Impact Fund finds a median grant of $1,000 for grants made in 2022.14“MS GIFT 2022 Impact Report.” Morgan Stanley Global Impact Fund. https://www.morganstanley.com/content/dam/msdotcom/what-we-do/wealth-management-images/gift/ms-gift-impact-report.pdf. The typical DAF donor distributes almost twelve grants per year, with 88 percent of DAF accounts distributing at least one grant in 2023, and after five years 76 percent of all contributions have been granted to charities, according to Fidelity Charitable’s 2024 Giving Report.

Importantly, around two-thirds of contributions to DAF accounts are non-cash assets (such as tangible personal property or stock in a private company). At Fidelity Charitable and Schwab Charitable, non- cash contributions to DAFs made up 63 and 64 percent of contributions in 2023 respectively. At Fidelity Charitable, since inception $13.2 billion in donated assets have been made available for charitable giving, while an additional $22.2 billion have been made available thanks to tax-free investment growth. In other words, donors of assets were able to almost triple their initial donation value. It is important to note the donation as well as any appreciation is all irrevocably dedicated to charitable granting.

The most popular recipient charities of Morgan Stanley DAF grants in 2022, according to the Morgan Stanley Global Impact Fund were: 1) Doctors Without Borders, 2) Environmental Defense Fund, 3) International Rescue Committee, and 4) Samaritan’s Purse. The most popular recipients in 2023, according to Fidelity Charitable were: 1) Doctors Without Borders, 2) St. Jude Children’s Hospital, 3) American Red Cross, and 4) The Salvation Army.

Community Foundation Daf Payout Trends

Critics frequently raise questions about DAF payout rates, or the percentage of DAF assets granted to charitable causes annually. According to the available data from 2020- 2022 on assets and grants collected from forty large community foundations around the country, the three year average DAF payout rate was 17.1 percent. The mean payout rate varied from year to year within a range of 16.9 percent in 2021 and 17.4 percent in 2020. The pooled mean payout rate varied from 22 to 27.4 percent, while the median payout rate over the three year period averaged 14.8 percent. These figures are close to the findings of community foundation payout rates estimated in the National Philanthropic Trust DAF Report.15“The 2023 DAF Report.” National Philanthropic Trust. November, 2023. https://www.nptrust.org/philanthropic-resources/philanthropist/highlights-from-the-2023-daf-report/. Figure 1 below shows mean, median, and pooled mean payout rates for each of the three years analyzed.

Figure 1: Community Foundation DAF Payout Rate: 2020-2022

While the average and median payout rates provide a general overview, the analysis also revealed substantial variability in DAF payout rates among community foundations. Some foundations exhibited exceptionally high payout rates, reaching up to 60 percent, and showcasing a donor community with a short- term approach to distributing funds. On the other hand, other foundations have payout rates as low as 6 or 7 percent, suggesting the use of DAFs as endowed accounts, supporting long-term giving and continued grantmaking. As many as 60 percent of DAF accounts at some community foundations are endowed (or “permanent”) funds—for these funds community foundations recommend grantmaking of around 4-6 percent of account funds every year.

Figure 2 below shows the distribution of average DAF payout rates among the forty community foundations analyzed. The data reveal a majority of community foundations report average DAF payout rates between 8 and 20 percent. Meanwhile, 30 percent of community foundations had average DAF payout rates of 20 percent or higher, and none of the forty community foundations had three year average payout rates below 5 percent, which, for reference, is the required annual payout rate for private foundations.

Figure 2: Distribution of Average DAF Payout Rate

Another way to measure payout activity is to review the flow rate of DAF funds among the sample of community foundations. The flow rate is the proportion of grants being paid out by DAF accounts compared to the contributions they receive. Among the sample of forty foundations, the three year average flow rate was 96.1 percent, while the median flow rate was 88.7 percent, meaning donors paid out almost as much in grants as they contributed to their accounts. Figure 3 below shows how the mean and median flow rate varied over the 2020-2022 period, with both mean and median flow rates exceeding 100 percent in 2022. In other words, in this year DAF donors paid out more to charities than they contributed to their DAF accounts—a sign of donors responding robustly during times of greater need.

Figure 3: Community Foundation DAF Flow Rate: 2020-2022

Figure 4 below shows the distribution of average DAF flow rates among the forty community foundations averaged over the three year period. The data reveal a majority of foundations with average flow rates between 50 and 109 percent, while one in four had average flow rates between 90 and 109 percent.

Figure 4: Distribution of DAF Flow Rates

Community Foundation Inactivity Policies and Account Minimums

DAF critics also say funds donated into a DAF are allowed to sit and never be granted out. Our analysis explored the practices of community foundations with DAF accounts that remained dormant for extended periods. Among the foundations that listed their DAF inactivity policies on their websites or responded when asked about their policies, a few distinct approaches emerged. The community foundations that responded or publicly listed their policies represent 83 percent of DAF accounts in our full sample. Among those, 98 percent enforced stringent and well-defined inactivity policies. Only 2 percent of DAF accounts did not have an inactivity policy. When asked about the absence of a policy, the most common response was that payout rates were exceedingly high, so there was no need for such guidelines.

Figure 5 below demonstrates the range of timelines that community foundations use in determining whether a DAF account is dormant. Seventeen percent of DAF accounts are considered inactive when no grants are made for two consecutive years, 71 percent after three years of inactivity, and 4 and 6 percent at four and five years respectively. As our prior analysis has demonstrated, three years seems to be the most common industry standard for determining whether a DAF account is inactive.16Salmon, Jack. “Community Foundation Use of DAFs in California: Payouts, Flow Rates, and Inactivity Policies.” Philanthropy Roundtable. November 2, 2023. https://www.philanthropyroundtable.org/resource/community-foundation-use-of-dafs-in-california/. This range of time frames highlights the diverse strategies employed by foundations to encourage timely and purposeful grantmaking.

Figure 5: Time Frames Sponsors Consider “Inactive”

Inactive accounts are the target of DAF critics, but this analysis unveiled various policies adopted by foundations that already exist to handle such situations. The most common policy response employed by 65 percent of community foundations was to make grants on behalf of inactive account holders, ensuring the funds were directed to deserving causes consistent with the donor’s intent or prior giving patterns. The second most common policy for inactivity was to move inactive funds to the community foundation’s endowment fund, preserving the charitable intent but redirecting the assets to support the foundation’s long- term sustainability—this is the approach for 26 percent of foundations. The remaining 9 percent of community foundations opt to terminate or close the account if inactivity persists, streamlining their operations, and reallocating the funds to active philanthropic efforts.

Another valuable feature of DAF accounts to consider is the minimum contribution required to open a DAF account at a community foundation. This is a valuable metric to observe when considering the accessibility of DAF accounts. Figure 6 below shows about one in eight DAF accounts at community foundations require no minimum contribution-these accounts are accessible to donors of all means. Sixteen percent of DAF accounts require a relatively low minimum contribution of $5,000, while a majority of accounts require a moderate minimum contribution of $10,000. Roughly one in six DAF accounts at community foundations require large minimum contributions ($20,000-plus) to open a DAF account.

Figure 6: Required Minimum Contribution

National Sponsor Daf Payout Trends

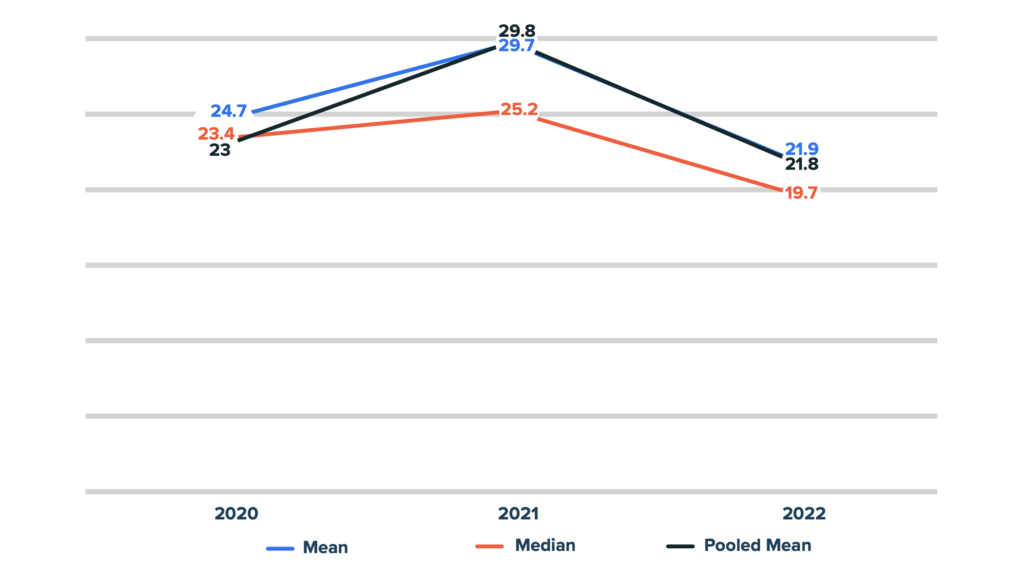

According to the available data from 2020-2022 on assets and grants collected from the ten largest national DAF sponsors, the three year average DAF payout rate was 25.4 percent. The mean payout rate varied from year to year within a range of 21.9 percent in 2022 and 29.7 percent in 2021. The pooled mean payout rate varied from 21.8 to 29.8 percent, while the median payout rate over the three year period averaged 22.8 percent.

These figures are close to the findings of the National Philanthropic Trust DAF Report, which finds mean payout rates at national sponsors fluctuating between 22 and 33 percent.

Figure 7 below shows mean, median, and pooled mean payout rates for each of the three years analyzed.

Figure 7: National Sponsor DAF Payout Rate: 2020-2022

The analysis also revealed substantial variability in DAF payout rates among the national DAF sponsors. Half of national sponsors have average payout rates between 15 and 24.9 percent, and half of sponsors have average payout rates of 25 percent or more. Notably, none of the ten national sponsors analyzed had three year average payout rates below 15 percent.

Figure 8 shows the distribution of average DAF payout rates among the ten national sponsors observed.

Figure 8: Distribution of Average DAF Payout Rate

National Sponsor Inactivity Policies and Account Minimums

The analysis explored the practices of national sponsor organizations concerning DAF accounts that remained dormant for extended periods (as defined by sponsoring organizations). Among the sponsors that listed their DAF inactivity policies on their websites or responded when asked about their policies, a few distinct approaches emerged. The national sponsors that responded or publicly listed their policies represent 89 percent of DAF accounts in our full sample. Among those, 100 percent enforced stringent and well-defined inactivity policies.

Figure 9 demonstrates the range of timelines national sponsors use in determining whether a DAF account is dormant. Slightly more than half (51 percent) of DAF accounts are considered inactive when no grants are made for two consecutive years. Twenty-six percent of accounts are considered inactive after 2.5 years, and 18 percent after three years. The remaining 5 percent of DAF accounts do not have timed payout rules, but instead mandate that DAF advisors grant out more than 5 percent of their account balance averaged over five years.

Fig. 9: Time Frames Sponsors Consider “Inactive”

Once a DAF account has been deemed inactive, the study unveiled various policies adopted by national sponsors to handle such situations. The most common policy employed by 75 percent of sponsor organizations is to grant out either 5 percent of the account balance on the advisors’ behalf or in accordance with the succession plan. Other national sponsors (25 percent) choose instead to move the inactive funds to their organization’s endowment or special gift funds, or to grant out the entire inactive balance within a six-year time frame.

Finally, national sponsor organizations have varying minimum contribution requirements for opening a DAF account. National DAF sponsors studied appear to set lower minimums, allowing donors of all means to open an account. In fact, 68 percent of accounts at national sponsors examined here have no ($0) minimum required contribution to open a DAF account. As figure 10 demonstrates below, 6 percent of accounts require a small minimum contribution ($1-5,000), 11 percent require a $10,000 minimum, and 15 percent have a high minimum contribution of $25,000.

Fig. 10: Required Minimum Contribution

Conclusion

Donors Engage in Regular and Generous Giving Through DAFs

DAFs have become a powerful tool for charitable giving, empowering individuals to support causes they care about with flexibility and ease. This report sheds light on the positive impact of DAFs, dispelling myths and highlighting real-world stories of transformative philanthropy. The analysis reveals diverse practices among DAF sponsors, with payout rates ranging from 17.1 percent for community foundations to 25.4 percent for national sponsors analyzed here. These figures are comparable to established industry benchmarks.

Furthermore, the substantial number of DAF accounts (over 428,000 with $179.1 billion in assets) signifies the widespread adoption of DAFs as a philanthropic vehicle.

The report underscores the accessibility of DAFs, with many community foundations offering accounts with no or low minimum contribution requirement. A significant portion of large national sponsors require no minimum contribution to open a DAF account. The analysis also highlights well-defined inactivity policies across sponsors, highlighting the effectiveness of voluntary measures for DAF funds. The ease of donating non-cash contributions further underscores the inclusive nature of DAFs, allowing donors to leverage various assets for charitable purposes.

By embracing innovative approaches to address issues of inactivity and maximize the impact of inactive funds, community foundations and national sponsors demonstrate a commitment to facilitating charitable giving and equipping generous Americans to give back on the timeline that meets their giving goals.

The inspiring stories showcase the transformative power of DAFs. From supporting medical research to fostering teenagers in the care system, DAFs empower donors to make a lasting difference. Additionally, DAFs enable strategic philanthropy during crises, as exemplified by the response to the conflict in Ukraine or the devastation brought by Hurricane Helene in 2024. DAFs are a dynamic force in philanthropy, with continued growth and evolution anticipated. Understanding current trends and diverse voluntary practices is crucial for informed discussion about the future of DAFs and their role in shaping a brighter philanthropic landscape.